With gold prices holding firm above $4,000/oz, the precious metal spotlight has quickly focused on the silver market. The shiny metal has exploded to all-time highs, returning a staggering 100% yield in 2025.

In this week’s The Gold Spot, Scottsdale Bullion & Coin’s Precious Metals Advisors Joe Elkjer and Tim Murphy unpack the explosive short squeeze reshaping the silver market, reveal the significance of a fifty-year cup-and-handle breakout, and explore how far prices could climb — plus, a specific silver price forecast!

What’s going on with silver?

Over the past few months, investors have been justifiably glued to gold’s stellar performance. While the yellow metal has maintained its strength above the $4,000/oz threshold, its shiny cousin has been quietly shattering its own records.

In October, silver prices blew past $50 for the first time in history, blowing off a decades-long price ceiling. Throughout the next several weeks, the $53/oz to $54/oz level was tested several times before silver prices broke through to a fresh record of $58.49 on December 2.

Behind silver’s recent upward surge is an extraordinarily bullish scenario that’s been half a century in the making.

Greatest Short Squeeze in History?

Silver’s surge past $50/oz — a level it has repeatedly tested since 2011 — was anything but random. It reflects a market finally cracking under the pressure of long-running supply shortfalls and decades of price suppression. Those forces have been building quietly for years, and the latest breakout suggests the artificial ceiling on silver prices has finally given way.

What we’re seeing now is the early stage of what may become one of the most significant short squeezes in market history, driven by persistent physical deficits and the rapid unwinding of long-standing price manipulation.

“This short squeeze is high demand and very low supply. The demand is going to drive the prices higher. This is going to last for a long time.”

Marketwide Price Suppression

For decades, experts have pointed to a blatant disconnect between market demand and silver’s price action. After years of speculation, the federal sentencing of two JPMorgan precious metals traders confirmed that major players were manipulating silver prices. By shorting silver through massive sell orders on the futures market, they were able to artificially cap prices.

This manufactured ceiling is starting to burst as silver prices break through the $50/oz level. As rising demand forced prices higher, these short sellers have been forced to cover their positions, in turn pushing silver even higher.

This rapid wave of short-covering stressed bullion banks, which struggled to supply enough physical metal. At the time, leasing rates — the interest charged to borrow physical silver when inventories run thin — leapt by 39% due to scarce supply.

Source: The Bubble Bubble Report

Structural Supply vs. Demand Imbalance

The struggle of bullion banks to keep up with short-coverings and institutional silver demand doesn’t reveal the full breadth of the market’s underlying imbalance.

The Silver Institute expects 2025 to mark the fifth consecutive year of a global supply shortfall, with available silver consistently falling short of total demand. Some analysts estimate it could take several years of sustained investment in new projects before the market returns to balance.

Silver’s dual role as both an investment metal and an industrial necessity continues to strain supply. Central banks and retail investors are effectively playing tug-of-war with various industries, such as solar manufacturers and EV producers, over limited resources.

SUGGESTED READING

SUGGESTED READINGLittle-Known Facts About The Importance of Silver in Technology

READ NOW

Production limitations also hamper the silver supply. New mine development often takes 7 to 10 years or more, meaning supply cannot respond rapidly to sharp demand increases. Furthermore, industry estimates suggest that 70% to 80% of newly mined silver is produced as a byproduct of mining for other metals, such as copper, lead, and zinc.

The 50-Year Cup-and-Handle Pattern

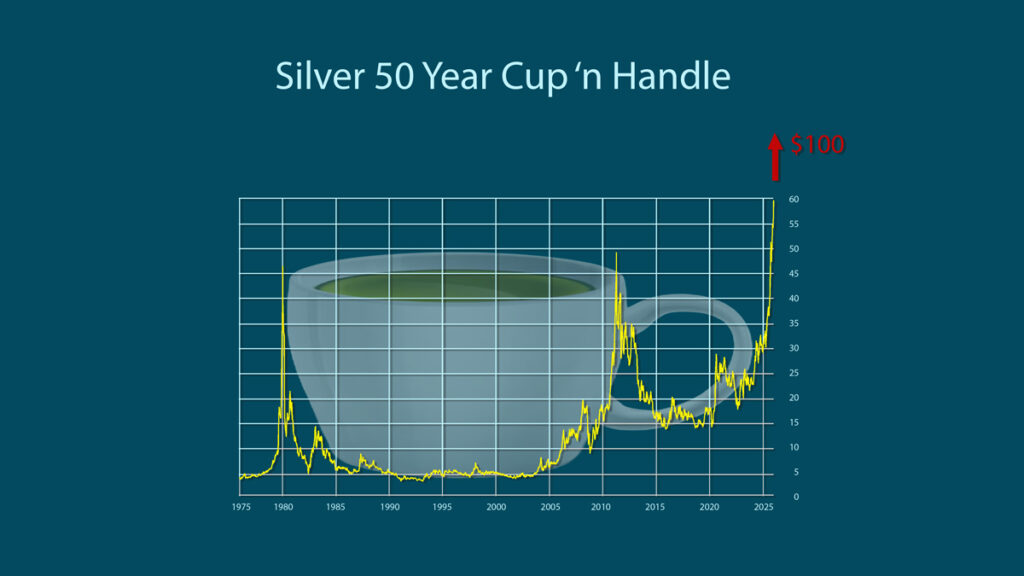

The behind-the-scenes market realities driving silver’s impending short squeeze have been mirrored on the price chart through a 50-year cup-and-handle formation. Silver first hit the $50/oz level in 1980 before collapsing and spending decades grinding lower.

It returned to that same $50 mark in 2011, forming the second side of the “cup” — a rare, multi-decade double top that established a long-term resistance line. The volatility of the silver market is, in part, due to the constant push-and-pull of legitimate silver demand and artificial suppression.

50 year silver cup and handle pattern chart 2025

From 2011 through 2024, silver moved through a prolonged consolidation phase that formed the “handle,” marked by lower highs, compressed volatility, and steadily tightening ranges. With prices now breaking decisively above $50/oz, the pattern is officially complete. This is perhaps one of the largest and most bullish formations ever seen in the precious metals markets, indicating the potential for a significant and sustained move higher.

This 50-year cup-and-handle formation is so, so bullish.–

Why the Pattern Points to $100/oz Silver

The completed cup-and-handle pattern also provides a straightforward technical price target. The range of the formation spans roughly $0 to $50. Applying the classic measured-move calculation, you simply add this range to the breakout level. A confirmed breakout above $50 therefore projects a technical target of roughly $100/oz silver.

“The silver breakout is really easy to measure. We should be looking at $100/oz this year, early next year. It’s going to happen. This is the most powerful technical formation that exists.”

This technical price prediction may only signal the beginning of broader growth, as many experts are calling for higher prices. For example, Eric Sprott believes the shiny metal can skyrocket to $250 and even $500.

Retail Investors Are Late to the Party. Will You Be?

Just when you think silver’s outlook couldn’t get more optimistic, the demand landscape hasn’t come close to reaching its full potential. Central banks in Russia and China have been actively stockpiling silver. Plus, the U.S.’s recent inclusion of silver as a critical mineral signals heightened official focus. However, retail demand remains limited, as shown by Commitment of Traders data. Thus far, the rally has been fueled by institutional and industrial buyers, leaving plenty of room to run from retail demand.

When the public jumps in…the sky is the limit.–

Historically, retail investors tend to enter the silver market late in the cycle, often during or after major breakouts. If that pattern repeats, the next wave of buying could create the final, exponential leg of the move. For investors who want to understand the risks, opportunities, and allocation strategies around physical metals, this is an ideal moment to get informed. Claim a FREE copy of our Silver Investor Report to get started.

Holiday Gift Reminder: The 1oz Silver Bullet Set

Don’t forget about our limited-edition and rapidly selling Silver Bullet Gift Set. It’s the perfect holiday gift for that special someone. Each set includes a 1 oz .999 fine silver bullet (45 ACP replica), a custom revolver-style display cylinder, a premium gift box, and a complimentary one-hour range pass—all for just $99. Only 100 sets were produced for this release, and once they’re gone, they’re gone for the season.

All you need to do is call 1 (888) 652-1966 to secure yours today. Hurry up while supplies last!

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

“*” indicates required fields